ct sales tax exemption form

You can download a PDF of the Connecticut General Sales Tax Exemption Certificate Form CERT-100-B on this page. For other Connecticut sales tax exemption certificates go here.

Certificate A - California Sales Tax Exemption Certificate Supporting Bill of Lading.

. Ad New State Sales Tax Registration. Filing Season - DRS asks that you strongly consider filing your Connecticut individual income tax return electronically. Several exemptions are certain types of safety gear some types of groceries certain types of clothing childrens car seats childrens bicycle helmets college textbooks compact fluorescent light bulbs most types of medical.

Sales Tax Exempt Exemption information registration support. Connecticut offers an exemption from state sales tax on the purchase of electricity natural gas and water used in qualifying production activities. For other Connecticut sales tax exemption certificates go here.

In order to qualify for the sales tax exemption a farmer must first apply with the Department of Revenue Service DRS by filing Form REG 8. ST-5 Sales Tax Certificate of Exemption 14443 KB. - End of Filing Season FAQs.

Gas Tax - For updated information on the Suspension of the Motor Fuels Tax click here. Manufacturers and industrial processors with facilities located in Connecticut may be eligible for a utility tax exemption. You can download a PDF of the Connecticut Resale Exemption Certificate Form CERT-100 on this page.

- Click here for Income tax filing information. Taxpayers may only file paper forms if the electronic filing requirement creates a hardship upon the taxpayer. Connecticut Utility Sales Tax Exemption.

Electronic filing is free simple secure and accessible from the comfort of your own home. Utility Sales Tax Exemption. Contact the Tax department for a resale certificate.

To obtain a Connecticut sales tax exemption certificate Form CERT-119 for a purchase other than meals and lodging contact the Tax Department 203-432-5530. Ad Download Or Email CT JD-CV-3a More Fillable Forms Register and Subscribe Now. A purchaser must give the seller the properly completed certificate within 90 days of the time the sale is made but preferably at the time of the sale.

- Click here for Income tax filing information. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Connecticut sales tax. I further certify that if any property so purchased tax free is used or consumed by the firm as to make it subject to a sales or use tax we will pay the tax due direct to the proper.

Ad Download Or Email CT DRS More Fillable Forms Register and Subscribe Now. 12-41260 Motor vehicles sold to limited liability companies or their members in connection with the organization or termination of the limited liability company provided the last taxable sale was subject to tax. Sales Tax Exemptions in Connecticut.

CERT-119 should not be used for purchases that are made for resale. The purchaser must complete CERT-125 Sales and Use Tax Exemption for Motor Vehicle or Vessel Purchased by a Nonresident of Connecticut Conn. Online Filing - All sales tax returns must be filed and paid electronically.

Electronic filing is free simple secure and accessible from the comfort of your own home. This includes most tangible personal property and some services. ST-5 Certificate of Exemption.

The sales tax is 775 percent for vehicles over 50000. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Connecticut sales tax. Certificate B - Certificate Supporting Bill of Lading California Blanket Sales Tax Exemption.

Sales and Use Tax Forms. How to use sales tax exemption certificates in Connecticut. PA 95-359 established the exemption in its current form by limiting it to sales to organizations that have letters from the US.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. STATE OF CONNECTICUT DEPARTMENT OF REVENUE SERVICES SALES USE TAX RESALE CERTIFICATE Issued to Seller Address I certify that Name of Firm Buyer is engaged as a registered Wholesaler Retailer Street Address or PO. Sales tax exemption forms as well as business sales tax id applications sales tax returns and the full Connecticut sales tax code can be downloaded from the Connecticut Department of Revenue.

Treasury Department determining that they are tax-exempt under Sections 501c3 or 501c13 of the Internal Revenue Code. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Connecticut sales tax. A sales tax exemption certificate is needed in order to make tax-free purchases of items and services that are taxable.

In limited circumstances the University may purchase items for resale. Manufacturer Lessor Other specify City State Zip. This tax exemption is authorized.

The application is then either approved or denied. On making an exempt purchase Exemption Certificate holders may submit a completed Connecticut Sales Tax Exemption Form to the vendor instead of paying sales tax. This vehicle is exempt from the 635 Connecticut salesuse tax if it is used directly in the agricultural production process.

Certificate C - California Sales Tax Exemption CertificateForeign Air Carrier CDTFA-230-I-1. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Filing Season - DRS asks that you strongly consider filing your Connecticut individual income tax return electronically.

Please visit the Filing and State Tax section of our website for more information on this process. If approved form OR-248 Agricultural Sales Tax Exemption Permit is issued. Gas Tax - For updated information on the Suspension of the Motor Fuels Tax click here.

In Connecticut certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Department of Revenue Services State of Connecticut. Complete Edit or Print Tax Forms Instantly.

- End of Filing Season FAQs. The form must be forwarded to Taxpayer Services at DRS for review. For tax exemption you must present a valid Farmers Tax Exemption Permit Form R657 or mL657 from.

Larchmont Manor Sale Town Sea In 2022 Antique Items Larchmont Copper Pots

Ao Can T Make Additions Merely By Referring To Information Available In Form 26as Kolkata Itat Additions Understated Kolkata

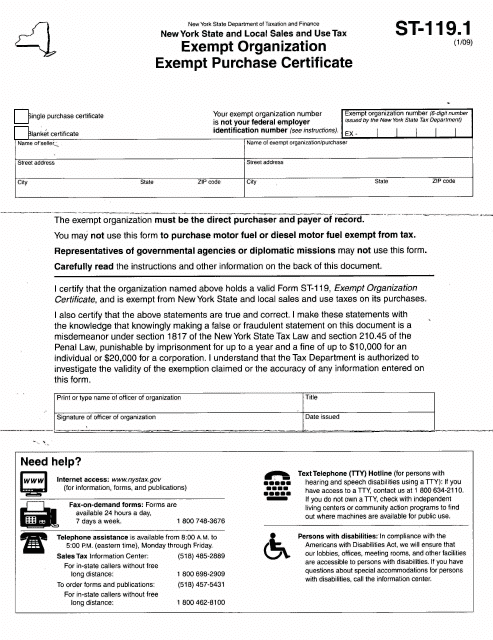

Form St 119 1 Download Fillable Pdf Or Fill Online New York State And Local Sales And Use Tax Exempt Organization Exempt Purchase Certificate New York Templateroller

Online Sales Tax Compliance Ecommerce Guide For 2022

Ohio Sales Tax Changes Sales Tax Nexus Tax

Businessusetaxexemptform Motion Raceworks

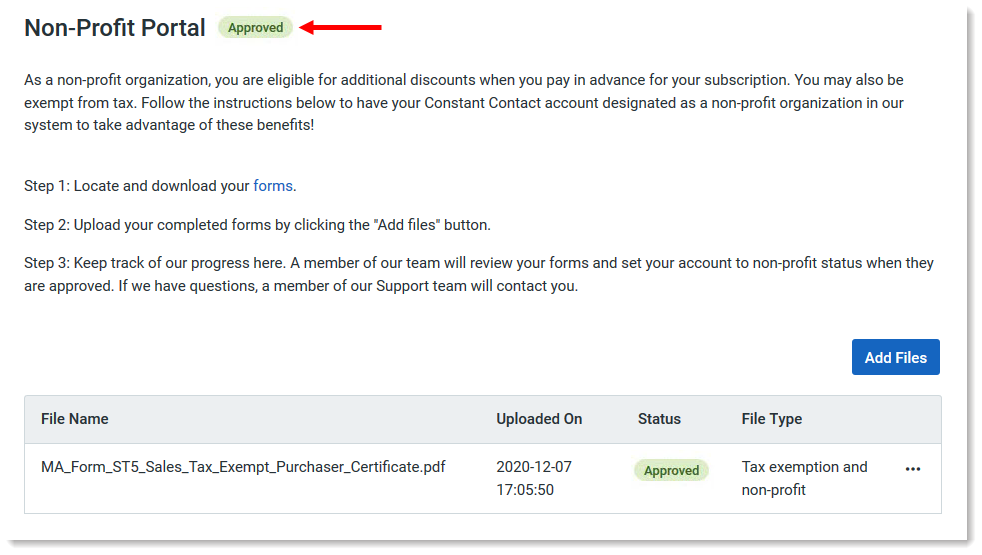

How To Submit Documentation For Sales Tax Exemption Help Center

Amazon Tax Exemption Program Atep

Sales Tax Exemption For Building Materials Used In State Construction Projects

Ohio Sales Tax Changes Sales Tax Nexus Tax

Glass Wood House House In The Woods Canopy Architecture Diy Canopy

Ohio Sales Tax Changes Sales Tax Nexus Tax

Larchmont Manor Sale Town Sea In 2022 Extension Dining Table Antique Items Dining Table

Tax Collection And Documentation Requirements For Nonprofits And Tax Exemption

Pair Of Marquise Shape Electric Blue Natural Brazilian Paraiba Tourmaline Paraiba Tourmaline Tourmaline Paraiba