federal tax abatement meaning

What Is a Tax Abatement. Tax Abatement A reduction of taxes for a certain period or in exchange for conducting a certain task.

The delinquent payment penalty cannot exceed 25 of the taxpayers outstanding tax liability for the year.

. The federal tax abatement reduces Part I tax payable. Tax abatement means a tax incentive given to business for the purpose of spending it in another way. Tax Abatement Meaning.

More from HR Block Penalty abatement removal is available for certain penalties under certain circumstances. In most jurisdictions there are multiple programs that abate property taxes if a person or the property is eligible. Removing Penalties Owed If you dont believe that you should have to pay certain federal penalties or interest you can apply for IRS penalty abatement.

For instance local governments may offer abatements to cover the cost of building new infrastructure to incentivize development or. If both the failure to file and failure to pay penalties. You have paid or arranged to pay any tax due.

This 10 deduction is meant to leave room for the provincial tax rates. A tax abatement is a property tax incentive government entities issue that will reduce or eliminate taxes on real estate in a specific area. Taxpayers who fail to file a tax return or pay a penalty can request that the IRS abate them in writing.

Income earned outside Canada is not eligible for the federal tax abatement. On line 608 enter the amount of federal tax abatement. Definition of tax abatement.

In other words when a taxpayer is eligible for tax abatement the taxpayer will get tax relief for a. To qualify you need to prove that there was a reasonable cause for filing or paying late. If you qualify the IRS removes some or all of your penalties.

Examples of an abatement include a tax decrease a reduction in penalties or a rebate. 7 hours agoTax abatements. IRS Definition of IRS Penalty Abatement You may qualify for relief from penalties if you made an effort to comply with the requirements of the law but were unable to meet your tax obligations due to circumstances beyond your control.

A corporation earns income from a Canadian province if it has a Permanent Establishment in that Province. These perks allow a business to focus on the future rather than trying to survive in the present. Tax abatements last for a specific period of time ranging from a few months to a few years.

It may be to your advantage to wait until you fully pay the tax due prior to requesting penalty relief under. What are tax abatements. Tax breaks for research and development depreciation and more.

Taxpayers use Form 843 to claim a refund or abatement of certain overpaid or over-assessed taxes interest penalties and additions to tax. The city of Cleveland has unveiled proposed changes to its longstanding residential property tax abatement policy which aim to tailor incentives to differing market conditions. Property tax abatements are offered by some cities in the form of programs that reduce or eliminate property tax payments on qualifying property for a set amount of time to be determined on an individual case basis.

Although towns and cities typically offer. Provincial Abatement 10 Taxable Income earned in a Canadian ProvinceTerritory. The failure-to-pay penalty will continue to accrue until the tax is paid in full.

Taxpayers should understand the difference between tax abatement and tax penalty abatement to avoid confusion. Oral or written advice by IRS on a tax return position that taxpayer reasonably relied on. A sales tax holiday is another instance of tax abatement.

An abatement can be in the form of a property tax abatement or a tax break. Tax Penalty Abatement Tax abatement is a kind of relief the IRS grants to taxpayers who exert effort to comply with the law but are unable to fulfill their tax obligations because of uncontrollable events. A tax abatement is when a taxpayers tax bill or tax liability is reduced or even brought to zero for a certain period of time and depending on various eligibility factors.

A tax abatement is an incentive that removes or reduces the amount of taxes an individual or company pays on a residential or commercial property. Line 608 Federal tax abatement The federal tax abatement is equal to 10 of taxable income earned in the year in a Canadian province or territory. An amount by which a tax is reduced.

For most penalties late filing late payment and return error the basic five reasons the IRS abates penalties can be summarized below. In broad terms an abatement is any reduction of an individual or corporations tax liability. The IRS grants abatement or tax relief only to taxpayers who have proven reasonable causes behind a penalty despite tax trouble.

Taxpayers who use Form 2210 however have the option of removing the penalty if a refund is requested. Information about Form 843 Claim for Refund and Request for Abatement including recent updates related forms and instructions on how to file. Abatements can last anywhere from just a few months to multiple years at a time.

What Does Penalty Abatement Mean. Low- to middle-income residents are usually the target demographic for these programs. Permanent Establishment is based on having one of the following.

The term commonly refers to tax incentives that attempt to promote investments that boost economic growth or provide other social benefits. For example if one receives a tax credit for purchasing a house one receives tax abatement because one pays less in taxes than heshe otherwise would. The penalty for late paying an income tax obligation is a monthly charge 05 of the taxpayers outstanding tax liabilities starting from the taxpayers tax payment due date.

After the taxpaying taxpayer applies abatement to his or her penalties they are removed. Tax abatements are reductions in the amount of taxes an individual or company is responsible for paying. These motivations are common to in the business world.

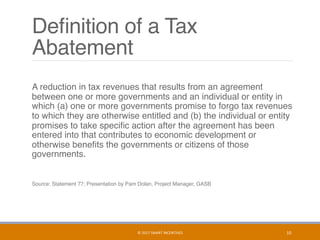

Property tax abatement is a decrease in the amount of money owed to a governmental tax authority on a real property tax bill. Tax abatement involves real estate properties while tax penalty abatement involves a taxpayer asking the IRS for a reduction or elimination of tax penalties for late tax payments or incorrect amount of taxes paid. An abatement is a reduction or an exemption on the level of taxation faced by an individual or company.

Module 8 Taxable Income And Tax Payable Pd Net

What Is Definition Of Refundable Quebec Abatement Cubetoronto Com

How Do I Know If I Am Exempt From Federal Withholding

Chapter 15 Taxable Income And Tax Payable For Corporations Ppt Download

What Is Tax Abatement A Guide For Business Operators

Chapter 15 Taxable Income And Tax Payable For Corporations Ppt Download

What Is A Tax Abatement Quickbooks Canada

Dividend Gross Up And A Dividend Tax Credit Mechanism

What Is Federal Tax Abatement Canada Ictsd Org

Canadian Tax Principles 2015 2016 Edition Volume I And Volume Ii 1st Edition Byrd Solutions Manual By Zachary Issuu

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

What Is Federal Tax Abatement Canada Ictsd Org

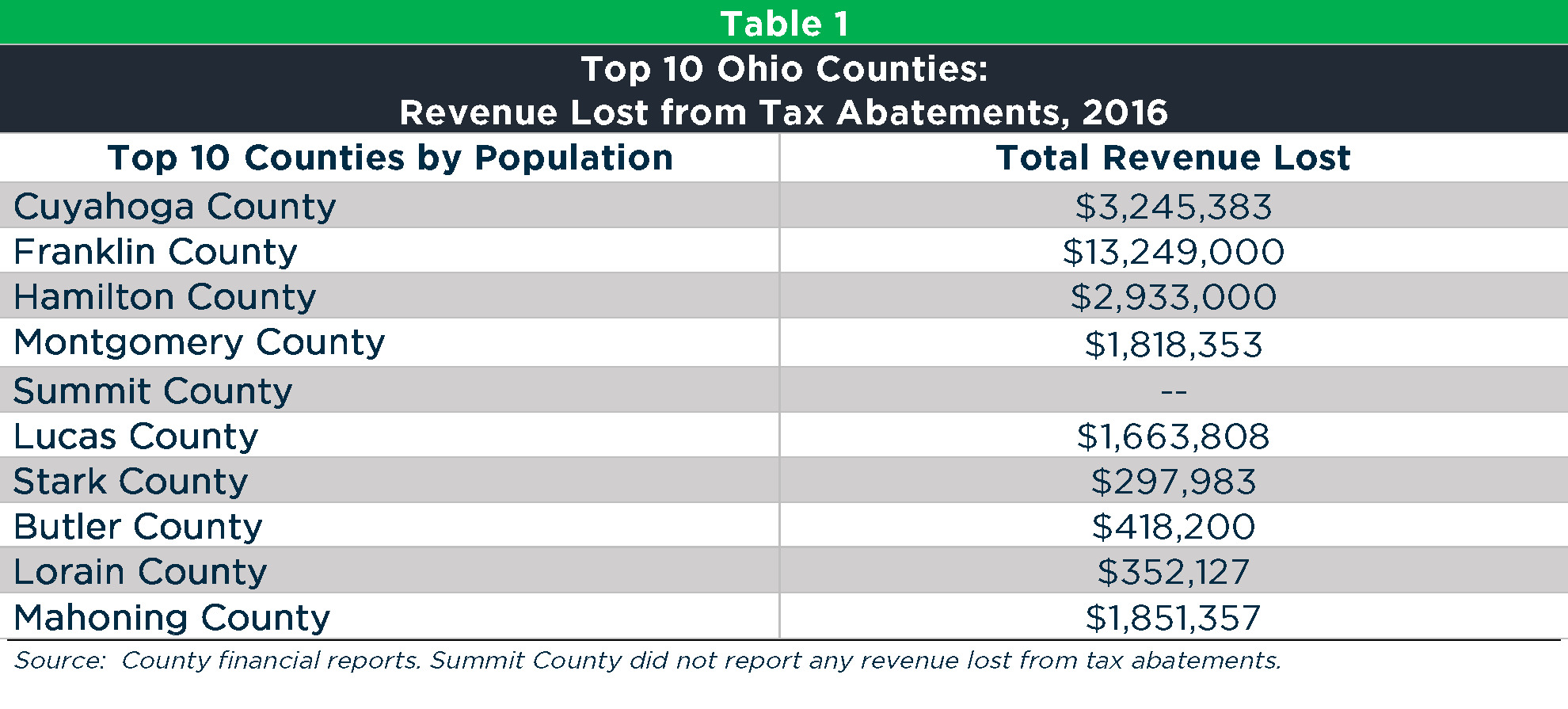

Local Tax Abatement In Ohio A Flash Of Transparency

Kalfa Law Business Tax Rates In Canada Explained 2020

How To Prepare Corporation Income Tax Return For Business In Canada

What Is A Tax Abatement Quickbooks Canada

Harpel Gasb 77 Tax Abatement Disclosure Workshop

A Canadian Guide To Filing And Paying Corporate Tax Bench Accounting