tax identity theft examples

Unlike some other forms of identity theft it can be hard to take preventative measures to avoid tax identity theft. Business identity theft is more complex than individual identity theft.

Identity Theft Prevention Don T Become A Victim Of Id Theft Youtube

One early sign that your SSN may soon be used by an ID thief involves receiving a notice from the IRS informing you that a new online account was just created at IRSgov.

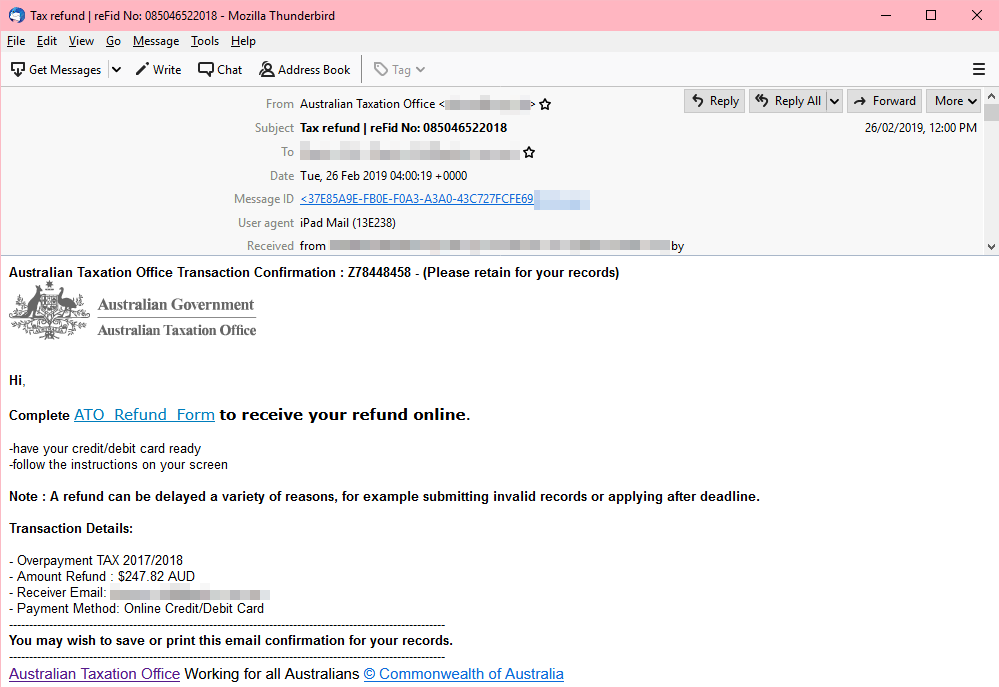

. Cant Say It Referred Any for Prosecution The Internal Revenue Service has posted online 369 examples of identity theft investigations conducted by IRS CI that were successfully. While on the surface these occurrences may appear to indicate business identity theft they may also stem from. This is commonly seen in cases of tax identity theft when someone files a tax return in another persons name before they file their own.

If you didnt make this account yourself someone may be impersonating you with your personal information. According to the Federal Trade Commission there are 7 categories of identity theft. Ad Your Digital and Financial Identity Face Constant Risks.

Identity theft sometimes referred to as identity fraud is a crime that carries serious consequences. An identity theft victim from Sarasota Florida realized she was a victim of identity theft when someone used her social security number to file taxes with the federal government. When they dont pay the bills the delinquent account is reported on your credit report.

Many of the same indicators that signify simple filing or processing errors also hint at business identity theft. Passports are another common item in a case of identity theft as passports contain sensitive information that can be just as powerful as a drivers license for the purposes of identification. Go on spending sprees using your credit and debit account numbers to buy big ticket items like computers or televisions that they can easily re-sell.

Identity theft is the act of stealing another persons personal identifying information in order to gain access to his financial resources or obtain access to other benefits such as money credit or insurance benefits. Throughout our history there were many examples of identity theft some less serious and some that led even to war. When youre the victim of tax identity theft your next steps will depend on how the fraud was noticed.

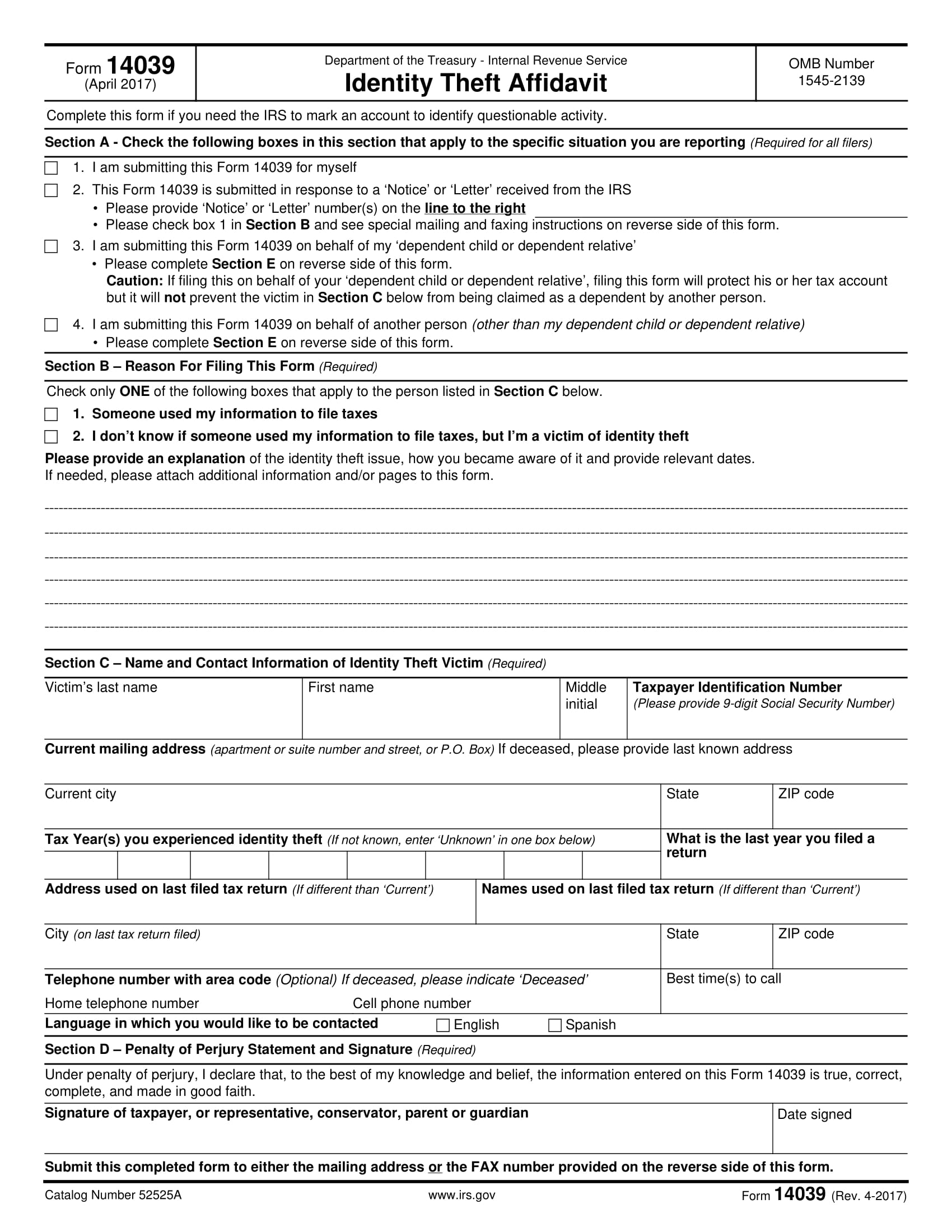

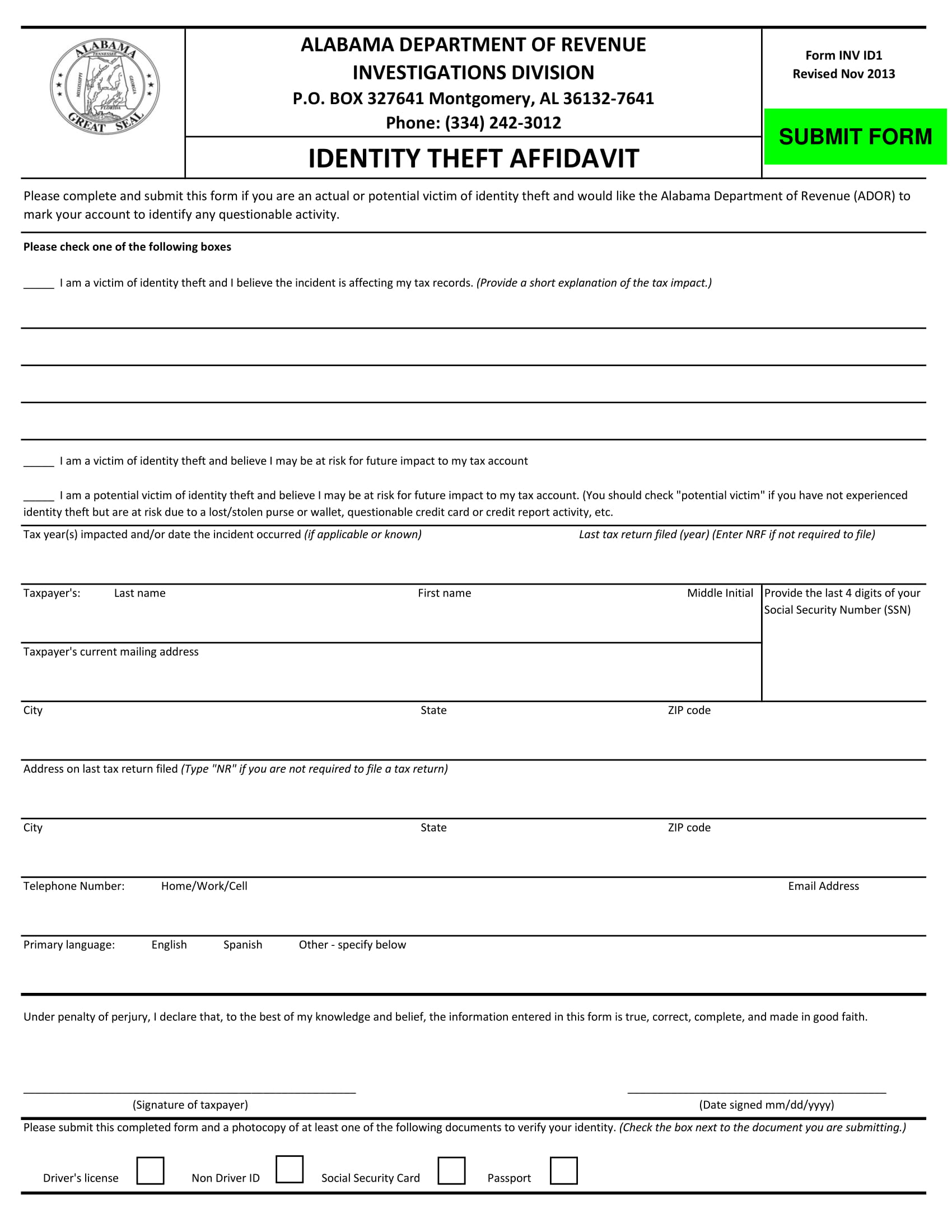

You Need Constant Protection. Examples of signs of identity theft include receiving notices from the IRS on a variety of unexpected matters andwell known to tax preparersrejection of a tax return from e-filing. Fill out and submit IRS Form 14039 Identity Theft Affidavit.

Complete an IRS Identity Theft Affidavit. Lets go back to 16th century Russia where the false son of Ivan the. Examples of Identity Theft Investigations by IRS.

ID theft through a tax professional. Fortunately tax identity theft wont lead to losing a tax refund if youre owed one. Passports and Drivers Licenses.

Some fraudsters might email your employees or customers while pretending to be your business. It can however result in delays as you work with the IRS or state tax agencies to resolve the issue. Identity Theft Insurance underwritten by insurance company subsidiaries or affiliates of American International Group Inc.

Examples of Identity Theft Crimes. This route gives them access to much more information than just one single person making it a much larger tax-related fraud scheme. 1 IRS Tax Identity Theft.

IRS Documented 13M Identity Thefts by Illegal Aliens. Recognizing tax ID theft. Our Comparisons Trusted by 45000000.

IRS tax identity theft occurs when a criminal uses the personal information of another taxpayer to file the annual income tax and receive the other persons tax return. Identity theft is the purposeful use of another persons identity for personal gain. For example if someone gets arrested and uses your stolen drivers license or state ID card.

The form can be submitted electronically at. The description herein is a summary and intended for informational purposes only and does not include all terms conditions and exclusions of the policies described. Protect Yourself From A Wide Range of Identity Threats.

Ad Read Trusted Identity Fraud Protection Reviews. The Federal Trade Commission FTC has a fillable Form 14039 on wwwidentitytheftgov. Criminals perform this type of crime on a large scale putting many people at risk.

These include the use of phishing emails fake invoices and tax filing. This type of ID theft happens when fraudsters break into the secure systems of actual tax preparers and online tax preparing systems. After completing the fillable form online youll need to print it attach it to your tax return and send it to the IRS through the mail.

As a result you can be held. File an Identity Theft Report with the FTC. However a common way this theft is.

What to Do if Youre the Victim of Tax ID Theft. Youll use IRS Form 14039 to report the identity theft to the IRS. Tax Fraud Identity Theft Examples.

Massive data breaches of corporations that handle your personal. There are a number of tactics identity thieves use to profit off your small business. Hackers can use malicious software phishing emails and data breaches to steal your personal information and get access to your bank account Social Security benefits or medical records.

Once identity thieves have your personal information they may. The IRS has a specialized unit dealing with ID theft you can also contact them. Your Protection Is Always On With Real People Ready 247 To Help When You Need It.

Several action steps are encouraged with handy links and examples along with connections to various IRS resources see the Sidebar. Examples of business identity theft scams. Her insurance company immediately got her in touch with us.

Criminal identity theft is when someone gives law enforcement your credentials instead of their own. Identity Protection Specialized Unit. Open a new credit card account.

Credit Card Employment or Tax-Related Phone or Utilities Bank Loan. Tax identity theft occurs when someone steals your Social Security Number SSN and uses it to file a fraudulent return in your name in order to steal your refund assuming that youre entitled to one. If someone files a fraudulent tax return using your identity fill out an Identity Theft Affidavit and mail it with your tax return.

Identity theft related to tax administration. Read on to learn about the most common types and.

Irs Form 14039 Guide To The Identity Theft Affidavit Form

What Is Identity Theft Definition From Searchsecurity

5 1 28 Identity Theft For Collection Employees Internal Revenue Service

How Common Is Tax Identity Theft Experian

Please Don T Buy This Identity Theft Protection Services Malwarebytes Labs

Types Of Identity Theft And Fraud Experian

Identity Theft Examples In Real Life Fully Verified

Identity Theft Examples In Real Life Fully Verified

9 Id Theft Affidavit Examples Pdf Examples

Irs Letter 4883c Potential Identity Theft During Original Processing H R Block

What Is Identity Theft The 5 Examples You Need To Know

Tax Id What Is Tax Identity Theft And How To Protect Yourself From It Marca

25 Warning Signs Of Identity Theft Don T Fall Victim In 2022 Aura

What You Need To Know About Tax Scams Noticias Sobre Seguranca

How To Protect Yourself From Identity Theft Money

What You Need To Know About Tax Scams Noticias Sobre Seguranca

/identity-theft-in-asia-56fe41915f9b586195f2a98d.jpg)